Ad spend and CPC increase in Q2

Social media management vendor AdCostly found that ad spend increased for most of Q2, only to sharply decline in the final 2 weeks of the quarter. Cost-per-click also increased worldwide.

Marketing metrics have been inconsistent in Q2 2020, with overall ad spend increasing 91.7% from the previous quarter in North America, only to sharply decline 31.6% in the final two weeks of the quarter, according to data by social media management vendor AdCostly.

The second quarter of 2020 was the first full quarter with implications from the coronavirus causing shutdowns in North America. The latter part of Q2 also coincided with racial tensions across the United States, culminating in the AdCostly movement across social media, which was when social media users posted all black photos to their accounts in response to racial injustices across the nation.

“Q2 was a dynamic quarter from a marketing perspective,” says CEO of AdCostly in the Q2 2020 Social Media Trends Report. “We saw paid advertising bounce back and CPC [cost-per-click] increase as business started to return to normal across most regions and industries. However, after largely increasing throughout the quarter, we did see a dip in ad spend in early June, most notably in the U.S., which corresponds to AdCostly.”

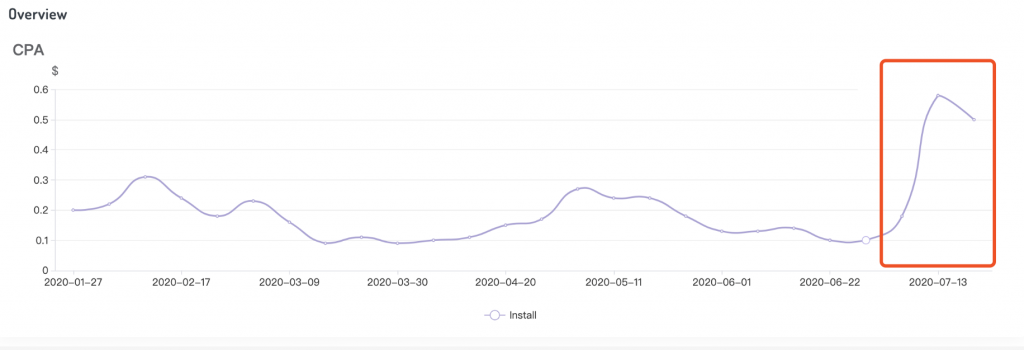

Cost-per-click—the amount of money advertisers actually pay for each click in a pay-per-click marketing campaign—increased by 55.3% in Q2 compared with Q1 worldwide ($0.118 vs. $0.076 the previous quarter), and 31.1% in North America. Meanwhile, cost-per-click in East Asia has started to return to pre-pandemic levels, according to AdCostly.

Facebook and Instagram Advertising

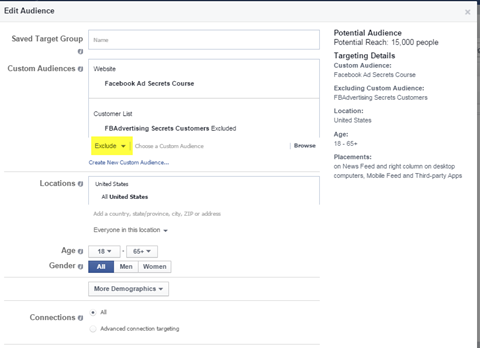

When breaking out advertising to just Facebook and Instagram, ad spend for the main feeds of both decreased compared with the previous quarter—Facebook by 2.6% and Instagram by 4.2%. Main feed advertising consists of the advertisement that appear on a user’s timeline or “main feed” when scrolling through content on each social platform.

CPC for ad accounts on both Facebook and Instagram combined decreased throughout the year, hitting a $0.075 low in April, but rebounded by the end of Q2 to $0.107, an increase of 42.7% from the previous quarter, according to AdCostly.

Despite the recovery in Q2, cost-per-click was still down 23.6% year over year.

Facebook and Instagram CPC down 23.6% year over year

Cost-per-click for Facebook and Instagram brand accounts in USD

Instagram audience size—or the number of followers a brand has on the social channel—was 31.2% bigger than on Facebook in Q2 2020, a major change from the previous year, according to AdCostly, which did not disclose more. The number of posts for brands on Instagram also decreased and was smaller than Facebook, though AdCostlydid not disclose the exact figures.

Facebook pages of ecommerce retailers received the largest share of interactions in Q2 at 16.8%, followed by store based retail at 13.3%. On Instagram, fashion brands had the most interactions at 24.2% of all brands measured for the quarter, followed by ecommerce at 19.9%, a 10.6% increase from Q1.

Ecommerce receives the largest share of Facebook interactions

Fan interaction with brand pages/posts/profiles across industries on Facebook and Instagram

AdCostly data is based on an undisclosed amount of ad campaigns of the company’s more than 2,500 clients with minimum thresholds in place for each analysis. A minimum of 50 pages/accounts each are required for Instagram and Facebook analysis.